What is changing in private assets?

Why tech and regulation are vital to the democratisation of private assets

As private asset investing widens into retail investments, governments have been pushing for greater investment in long-term, productive assets and have put in place a range of measures to do so.

The market has also come under the focus of the regulator who has created new rules amid the growth while also conducting a review into certain parts of the market.

Experts say that technology will also enable more retail investors to access private asset investments.

This report, which is worth 30 minutes of CPD, will explore how technology and regulation are vital to the democratisation of private assets.

Half of advisers to increase allocation to private assets

Half of financial advisers are looking to increase their allocation to private assets over the next 12 months, according to the latest FT Adviser poll for Talking Point.

Advisers were asked: Does the changing regulatory outlook make it more likely you will increase exposure to private assets over the next year?

Half said yes, 30 per cent said no, and 20 per cent were unsure.

An increasing number of managers are launching forays into these asset classes for the first time, as the search for portfolio diversification continues and regulation is set to make private assets available to more investors.

Meanwhile, the Financial Conduct Authority is also turning its focus to private assets; looking to conduct a review of the disciplines and governance around private market valuations.

On their investment approach in the private assets market, Wes Wilkes, chief executive of Net-Worth Ntwrk, says: “This is really where regulatory intervention actually helps. Assessing the current state of private assets, valuations in particular, should encourage stronger product and vehicle development and make the asset class more convenient to allocate to.

Philip Dragoumis, director and owner of Thera Wealth Management, adds: “For us, private assets should only be really considered (and then for a small allocation) if clients have net investable assets of above £10mn pounds.

"We are also wary of and tend to avoid venture capital trust and Enterprise Investment Scheme products due to their lack of global diversification, as they are predominantly UK based and their valuations are not always transparent or realistic.

“It seems the wealth market agrees with us, as the take up this year of these products is lower than anticipated.”

How tech and regulation are changing private assets

In recent years there have been moves to make private assets investing accessible to more retail investors.

Government has been pushing for greater investment in long-term assets and has put in place a range of measures to do so – most notably, increasing opportunities for investment by defined contribution and defined benefit pensions, the Mansion House compact, and the Long-Term Asset Fund

In Europe there is the European Long-Term Investment Fund regulation (ELTIF II) and a new regime for loan origination funds.

While this shows progress has been made by regulators to make access to private markets easier, Albane Poulin, head of private credit at Gravis Capital Management, says there is still a long way to go before they successfully reach the wider retail investor base.

Regulatory impact

As the UK government is pushing for more private investment, the Financial Conduct Authority has created new rules, with the introduction of LTAF.

LTAF is a new open-ended FCA-authorised investment fund to facilitate investment in long-term illiquid assets, combined with prescriptive rules around redemption and liquidity.

Redemption should be no more frequent than monthly, with a minimum 90-day notice period allowing retail investors better access to this market.

“However, this type of fund is relatively new and, so far, has primarily attracted high-net-worth individuals or professional investors. The fact that LTAF is not qualified for Isas probably doesn’t help,” Poulin says.

Read more: How will chancellor’s Mansion House plans impact pension providers?

The European Securities and Market Authority introduced similar rules in 2015 for the ELTIF, which did not attract enough capital due to rules relating to distribution to retail investors.

Poulin adds: “New rules in Europe coming into force in 2024 should open the door to a broader investors base.

“However, as the rules are more relaxed, with increasing proportions of liquid assets (40-45 per cent) in the portfolio, it could have a negative impact on the return profile of these types of funds.”

Nicholas Hyett, investment manager at Wealth Club, agrees that so far the new semi-liquid structures have not taken off among retail investors “at large”, although he continues to see appetite among his client base of more sophisticated, HNW investors.

Hyett adds: “Private banks are also seeing considerable flows among their client base. These are groups that are used to investing in less liquid assets anyway, and may well have invested in LP structures in the past.

“For them, semi-liquids actually improve liquidity compared to their current investments.”

Platform challenge

One of the factors causing the slow uptake among the wider investing community, according to Hyett, is in large part because the UK’s main investment platforms, through which retail investors access markets, have been slow to adopt the structures.

He says that platforms have not been performing very well to help advisers/retail investors access private asset investments, partly because of the different structures that require platform development work, which is expensive. The benefits are also “uncertain”.

As a result awareness of these investments is low, Hyett notes.

“It’s still early days, but we do expect more platforms to emerge that are dedicated to the private asset space. Currently a lot of that activity is still focused on LP fund structure though.”

Poulin adds: “I am not sure platforms do enough yet to tell retail investors how and why they should access private asset investments.”

Private banks are also seeing considerable flows among their client base.

With private markets consuming a lot of data, the range of technical and marketing reports, the amount of legal documentation, investment reports and financial modelling, Poulin says better technology can help investors to be more efficient and ensure they are consistent across each investment decision.

“However, a key component of that market is the ability to negotiate on a bilateral basis and create long-term relationships with borrowers, which is harder to replace with technology,” she adds.

Saying that, technology has allowed dedicated private asset platforms to establish themselves quickly.

As Hyett explains further: “That has probably meant that there’s been more early pick up among self-directed HNW/sophisticated investors than advised clients or DIY retail investors – since those investors are able to invest with fewer restrictions without taking advice.”

Pensions push into private assets

On the pensions side, the chancellor, the Lord Mayor of London, and the chief executives of some of the largest DC pensions schemes in the UK – including Aviva, Scottish Widows and Legal and General – have signed the Mansion House compact, which sees those schemes commit to allocating at least 5 per cent of their default funds to unlisted equities by 2030.

According to Hyett the current proposals are focused on DB pension and annuity managers, and are therefore unlikely to affect retail investors directly, although the higher potential returns in the private asset space could ultimately improve the annuity rates on offer.

“Instead the impact is likely to be greater in the end markets themselves. Increasing the capital available to private companies and boosting liquidity of unlisted assets, which is very much the rationale behind the policy in the first place,” Hyett adds.

Not all pension schemes are shifting allocation to illiquid assets, Poulin explains.

The liquidity crisis in 2022 forced smaller DB pension schemes to rethink asset allocation and reduce allocation to illiquid assets accordingly.

The very large DB schemes do, however, continue to increase their allocation to illiquid assets.

For example, Nest recently announced that they will double their exposure to private markets from 15 per cent to 30 per cent of their portfolio.

I am not sure platforms do enough yet to tell retail investors how and why they should access private asset investments.

So large DC schemes like Nest are looking to capture growth in this market as they believe it to be a stable source of income as well as offering additional protection – covenant/security for unlisted debt, stable valuation for unlisted equities.

Poulin adds: “Private market assets offer a range of opportunities to pension schemes generating additional returns and diversification to traditional investment.

“With the right governance in place, private markets will play a significant role in supporting crucial innovation in a range of sectors such as energy and social infrastructure, transportation, properties driven by evolving regulation, and government targets.”

Increased regulatory scrutiny

The increased interest and focus on private markets around the world has meant that regulators and “supervisors are alert to the risk of inaccurate valuations, conflicts of interest, poor liquidity and leverage controls, mis-selling and greenwashing risks”, according to a report by Deloitte.

The International Organization of Securities Commissions has warned that higher interest rates could increase defaults and threaten valuations in this relatively opaque market.

So regulators are calling for more transparency in private markets as part of the policy debate on non-bank financial intermediaries.

The note from Deloitte says: “Taken together, we expect this to result in a step change in the level of supervisory scrutiny of this sector in 2024.

I personally think it is good news and this will make funds more comparable for investors.

“Private markets firms will need to invest significantly to ensure that risk and compliance functions are appropriately resourced and that they have robust control frameworks and operational processes.”

In the UK, valuations are in the supervisory spotlight, where the FCA is conducting a review of valuation in private markets.

Meanwhile in the EU, Esma's recent common supervisory action on valuation highlighted particular risks for private equity and real estate assets.

Key concerns include subjectivity and potential conflicts of interest in the valuation process, and misalignments between the frequency of the net asset value calculation, the asset valuation, and the availability of up-to-date data.

Accurate valuations are especially important if investors can exit the product early or trade it in the secondary market.

The report by Deloitte adds: “In our view, firms should particularly focus on governance, which should provide challenge at key stages of the valuation process, from the methodology used, to the validity of the inputs, and the reasonableness of material judgements used to determine valuations.

“This challenge needs to be independent and to have the right level of seniority and expertise. Some firms are considering greater use of third-party valuers, this can provide more independence but firms should be aware that it does not absolve them of responsibility.”

Poulin says: “There is also now more scrutiny from regulators on how managers value private assets, but I personally think it is good news and this will make funds more comparable for investors.”

Ima Jackson-Obot is deputy features editor at FT Adviser

Private assets for wealth management clients: why and why now?

Wealth managers are allocating more client capital to private assets. We look at the reasons so many are doing so, and specifically why they’re doing it now.

Private client wealth managers have had robust arguments for allocating to private assets for some time. By 2021 four in five UK wealth managers had invested a portion of clients’ money in private assets.

These allocations are typically made in pursuit of enhanced performance and diversification, arguments that historic data continues to support. But other factors, such as the emergence of new vehicles for private asset investments, and the declining number of publicly-quoted companies, are also driving the trend.

Investors are also watching the investment landscape shift and assessing how resilient portfolios will be to a much altered environment. Of the major themes unfolding – like artificial intelligence and the renewable energy transition – many require private capital backing.

How robust are the return and diversification arguments?

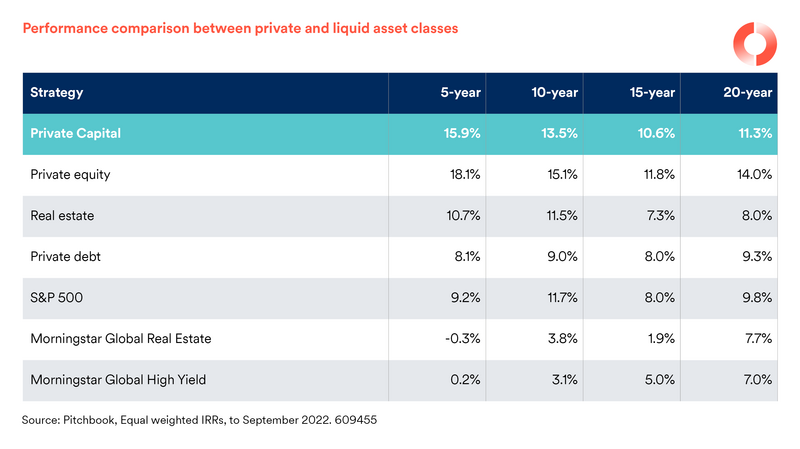

Past performance for numerous private asset classes compares favourably with liquid investment types, like traditional equities and bonds, over longer investment horizons.

Crucially, private markets also have a history of performing differently to liquid markets.

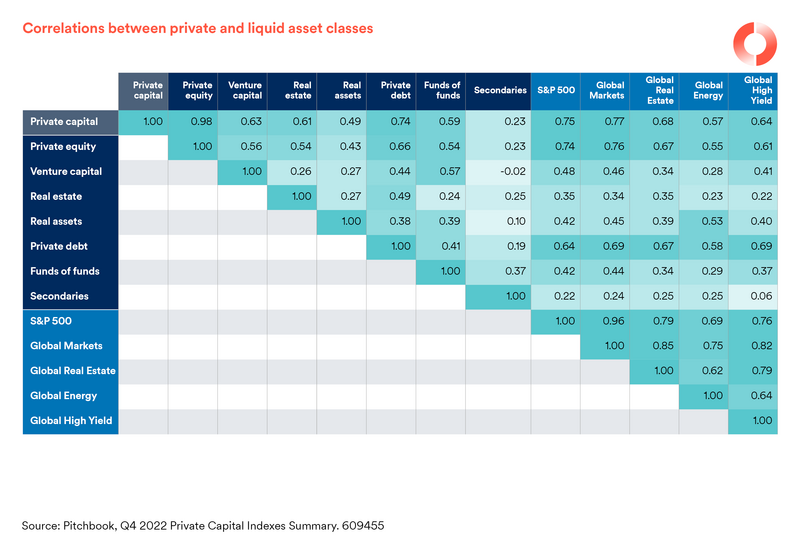

Measuring how different investments move relative to one another – the correlation – is crucial to creating meaningful diversification. Again, data indicates that private assets can contribute to portfolio diversification.

What do the numbers mean?

A correlation of 1.0 (technically the 'correlation coefficient') means two assets move in exactly the same way. Smaller numbers indicate lower correlation.

James Ellison, head of private assets data insights at Schroders Capital, explains: “Private market investments offer a compelling means of diversifying a portfolio. The correlation between private asset classes and public markets is lower, as shown by the table. This allows them to provide diversification benefits by moving independently of the public markets.

“As well as behaving differently to public markets, they tend to behave differently to each other; well-balanced private asset portfolios can help mitigate risk. Additionally, the investment strategy itself can create further diversification, such as private equity investing in the lower mid-market.”

New investment vehicles offer institutional-style private asset exposure for wealth managers and their clients

The above explains the familiar attractions of private assets for both advisers and their clients.

But what about the 'why now'? What has changed?

Even for those with private market allocations, the overall share of portfolio remains low.

The Investment Association found that private market investments comprised an average of 5 per cent of UK wealth managers’ assets under management in 2021.

By comparison, our own research indicates that institutional investors had allocated 14 per cent of their portfolio to private assets the same year.

This discrepancy is in part because institutional investors have had access to a much broader range of solutions, structures and private asset managers. The options for individual investors, advised or otherwise, has been limited.

In the UK, individual investors have been able to use investment trusts for exposure and little else. However, ongoing growth and development in the private asset industry is changing things.

The LTAF has been spearheaded by the Financial Conduct Authority as a “new category of open-ended authorised fund designed to invest efficiently in long-term assets”.

The FCA created a new regulatory regime in 2021 to realise the LTAF structure.

LTAFs were initially designed to put pension capital to work supporting the UK’s long-term economic growth and the transition to a low carbon economy.

New developments mean advised and discretionary investors will also be able to invest in LTAFs.

Widening the LTAF scope means more options in the UK authorised funds ecosystem, providing another access point to private markets for investors.

We expect the LTAF to be a complementary tool to existing private asset structures – like investment trusts – offering new flexibility in how UK investors will be able to meet their objectives via private market investments.

Public markets offer shrinking opportunity to access growth investments

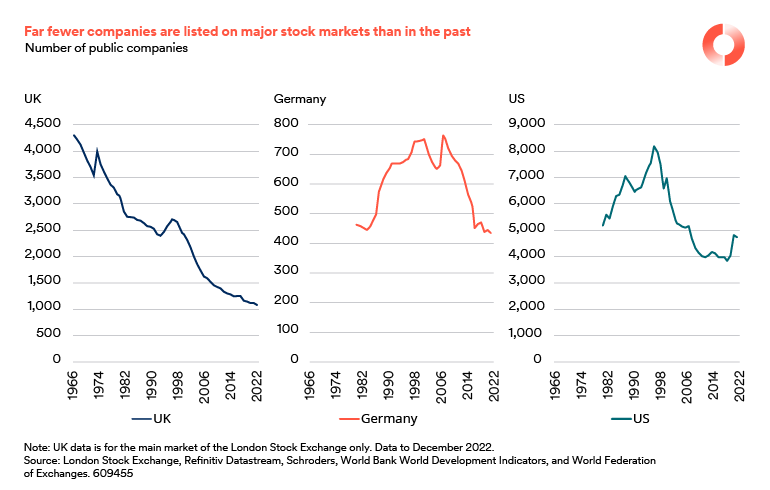

While access has improved for private markets, options in public markets have continued to narrow.

The number of listed companies has been falling for years, and not just in the UK. The trend has been echoed in major markets around the world.

In 1996 there were more than 2,700 companies on the main market of the London Stock Exchange.

At the end of 2022 this had collapsed to 1,100, a 60 per cent reduction. There has been a near -75 per cent fall in the number of UK-listed companies since the 1960s.

Germany has shed more than 40 per cent of its public companies since 2007 and the US has experienced a 40 per cent drop since 1996.

One of the most striking effects of this decline is that the stock market now provides exposure to a dwindling proportion of the corporate universe.

This is not just a UK issue: in the US, for example, fewer than 15 per cent of companies with revenue over $100mn (£79mn) are listed on the stock market. Ordinary savers are largely deprived of the opportunity to invest directly in the rest.

Investors who focus solely on the stock market are missing out on a large and growing part of the global economy. Where they can, investors will need to explore private asset options to capture the growing private investable universe.

James Lowe is sales director – private assets and investment trusts at Schroders